Judge rules in favor of Suffolk OTB in lawsuit over Jake's 58 property taxes

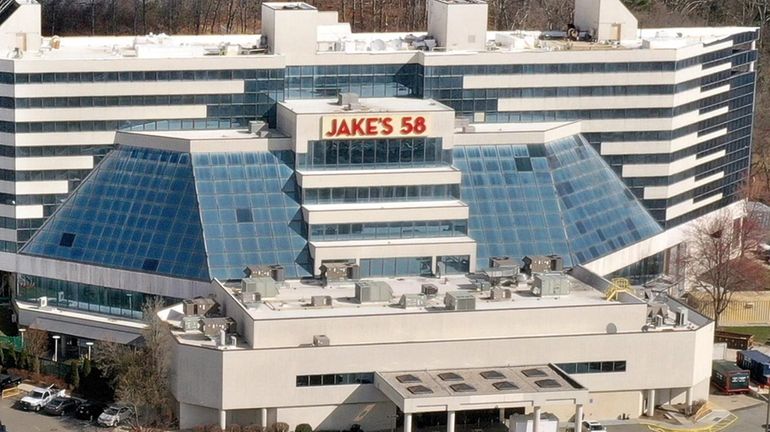

A judge has ruled that Suffolk OTB does not owe property taxes to Islip for its Jake's 58 Casino and Hotel in Islandia. Credit: Newsday/John Paraskevas

A state judge has ruled in favor of a property tax exemption for Jake’s 58 casino, a decision that could cost the Town of Islip more than $1 million a year.

State Supreme Court Justice John Leo ruled that the town’s denial of the casino operator's request for a tax exemption is “improper and illegal.”

Only 25¢ for 5 months

A state judge has ruled in favor of a property tax exemption for Jake’s 58 casino, a decision that could cost the Town of Islip more than $1 million a year.

State Supreme Court Justice John Leo ruled that the town’s denial of the casino operator's request for a tax exemption is “improper and illegal.”

There is no “credible opposition” to Suffolk Off-Track Betting Corporation’s argument that all Jake’s 58 operations are “directly related” to the company’s mission “to raise revenues for the government and to reduce illegal bookmaking,” Leo said in the July decision.

“The entire casino hotel is wholly tax-exempt” under state law, he added, “because the property is under the sole jurisdiction, control and supervision” of Suffolk Regional Off-Track Betting Corp. in support of the OTB’s “corporate purpose.”

Leo also said the casino and hotel "are not merely intertwined but are one singular business operation in support of the state government.”

Islip has filed a notice of appeal to the court’s decision and order, town spokeswoman Caroline Smith said. She otherwise declined to comment, citing the pending litigation.

Phil Boyle, head of Suffolk OTB, declined to comment on the decision.

OTB officials filed the tax suit Jan. 19 in Suffolk County’s State Supreme Court, alleging Islip Town has erroneously taxed about three-quarters of the casino property since OTB bought Jake's in 2021 from Buffalo-based entertainment conglomerate Delaware North.

The Hauppauge-based OTB, citing state law, argued the entire property should be tax exempt because the corporation is a government agency that already funnels 45% of net revenue to public schools.

Islip, in letters rejecting OTB’s requests for tax exemptions in 2022 and 2023, said most of the 19-acre property should not be tax-exempt because they are not part of OTB's core mission as a public benefit corporation.

Suffolk OTB has countered that the hotel is an important part of casino operations because free and discounted hotel stays are part of the betting parlor's rewards program.

The judge rejected Islip’s argument that Jake’s 58’s restaurant and hotel are unrelated to casino operations, noting that Suffolk OTB owns both and employs everyone who works there.

“Hotel operations are not unrelated to Jake’s 58 but are directly involved in its purpose to make money,” Leo wrote, adding that “free drinks, food, dine and stay packages and hotel rooms are all part of [the] Jake’s 58 operation and its mission.”

Islip stands to lose millions of dollars in future tax revenue for the town and other taxing entities such as the Hauppauge school district and library and fire districts if OTB prevails.

OTB paid about $1.3 million in property taxes to Islip in 2022-23, according to Islip Town.

Boyle has previously said the agency is entitled to the tax exemption after generating $600 million for the state Department of Education in recent years and tens of millions dollars more for Suffolk County. So far, in fiscal 2024-25, which began April 1, OTB has paid $56,550,917 to the public education fund, gaming commission records show.

Also since April 1, the casino has raked in $125,668,704 in net revenue after bettors receive their winnings, according to figures posted on the state Gaming Commission website.

The lawsuit may be the first case to tackle the question of whether some OTB properties should be taxed, Albany Law School professor Ted De Barbieri has previously told Newsday.

“Clearly local governments have an incentive to ensure that any instance of local property tax exemption is as narrow as possible, given what state law allows, because local government relies on property tax to provide basic services,” he said of Islip’s appeal.

“It’s not surprising at all that Islip would continue to pursue this claim in the appellate division, especially if this is a novel issue,” he added.

Paul Sabatino, a Huntington Station-based attorney who has represented casino opponents in the past, said he disagreed with the judge's decision.

He said, “Islip "had the more powerful argument.”

With Carl MacGowan

Breaking down the indictment of NYC mayor ... Another guilty plea in Babylon body parts case ... Teen dies from crash injuries ... RVC Diocese reaches settlement