Deadline for seniors' enhanced STAR exemption in Suffolk towns is March 1

To be eligible to receive the enhanced STAR exemption homeowners must already receive the basic STAR exemption, have one owner who will be at least 65 years old by Dec. 31 and have earned household income of $92,000 or less in 2020. undefined

Suffolk County seniors who qualify for the state’s Enhanced School Tax Relief exemption must apply by March 1.

To be eligible to receive the Enhanced STAR exemption homeowners must already receive the basic STAR exemption, have one owner who will be at least 65 years old by Dec. 31 and have earned household income of $92,000 or less in 2020.

Only 25¢ for 5 months

Suffolk County seniors who qualify for the state’s Enhanced School Tax Relief exemption must apply by March 1.

To be eligible to receive the Enhanced STAR exemption homeowners must already receive the basic STAR exemption, have one owner who will be at least 65 years old by Dec. 31 and have earned household income of $92,000 or less in 2020.

The deadline to apply in Nassau was in January, except for Glen Cove residents who have until May 1.

To qualify, applicants must submit an application, a supplemental form and proof of income in 2020.

The state Tax Department said 577,000 seniors saved more than $800 million from the Enhanced STAR exemption last year. That represents savings of nearly $1,400 per homeowner.

"We want every eligible senior to receive the increased property tax benefit," Amanda Hiller, acting commissioner of the Tax Department, said in a statement.

Homeowners who already receive the STAR credit, not the exemption, do not need to apply for the Enhanced STAR credit upon turning 65. The state will automatically upgrade their credit.

Homeowners receiving the exemption get a reduction to their school taxes, whereas tax credit recipients are mailed a check from the state each year. The enhanced exemption is only available to homeowners who have had the non-senior form of the exemption on the same property since at least the 2015-2016 school year.

Otherwise, seniors can apply to get a check in the mail from the enhanced STAR credit, which is also restricted to households earning $92,000 or less.

The basic STAR credit, which varies in value, is available to younger homeowners and those with higher incomes. Residents who receive a property tax exemption on a separate property elsewhere in New York or a different residency-based tax benefit in another state aren’t eligible.

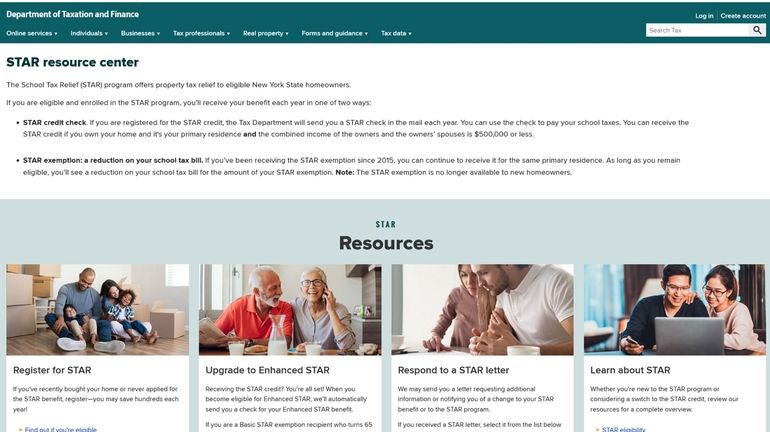

More information is online at tax.ny.gov/star or by calling the Tax Department’s STAR hotline at 518-457-2036, which is available 8:30 a.m. to 4:30 p.m. on weekdays.

Takeaways from Trump rally ... The $6.5M house that pizza built ... What's up on LI ... Get the latest news and more great videos at NewsdayTV